There have been many changes in 2020 and with the rise of the gig economy, it was only about time before there were some changes to form 1099 in 2020. Below, we walk you through everything you need to gather to properly file your 1099 Form for 2022.

What Has Changed for the 1099 Form?

The IRS has created a separate form for 2020 to report independent contractor payments. Henceforth, independent contractor payments will be reported in form 1099-NEC which you would earlier report in 1099-Misc.

If you’re new to this, NEC stands for Non-Employee Compensation which is payments for Independent Contractors. For instance, before this change, independent contractor payments used to be reported in Box 7 of 1099-MISC.

1099-MISC vs. 1099-NEC

Form 1099-MISC differs from Form 1099-NEC in one distinct way. As a business owner, you should know the difference between Form 1099-NEC and Form 1099-MISC. Therefore, if you pay contractors or vendors, you need to fill out, distribute, and file the correct form. A business will only use Form 1099-NEC if it is reporting non-employee compensation.

The difference between Forms 1099-NEC and 1099 MISC might be confusing at first, so we’ve compiled this guide to help you understand the differences between these forms. Without further ado, here’s everything you need to know about Form 1099-MISC and 1099-NEC.

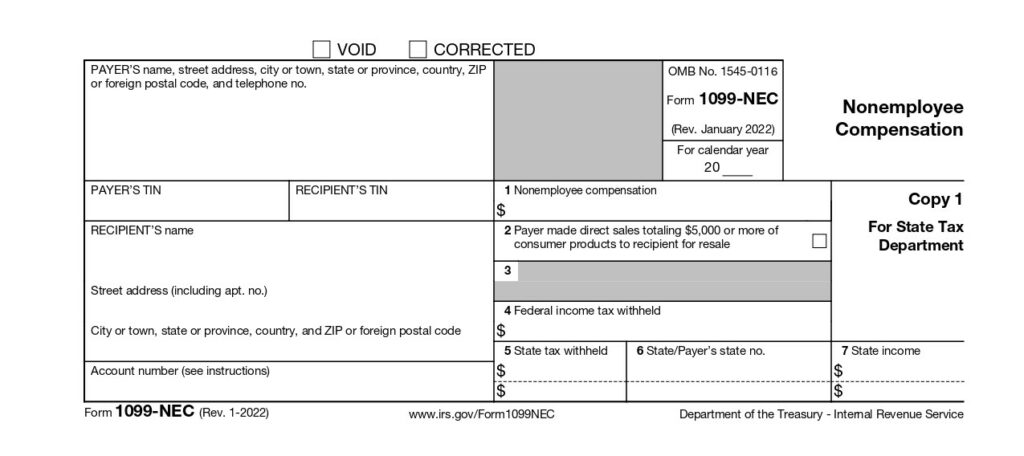

What is Form 1099-NEC?

This is a new tax form specifically for reporting non-employee compensation. This is defined as payments to individuals who are not on payroll to complete a project or assignment. The IRS has reintroduced Form 1099-NEC as the new way to report self-employment income instead of Form 1099-MISC as traditionally had been used.

Form 1099-NECs cannot be downloaded from the IRS website. Instead, you’ll need to order them from their website or file them online via FIRE.

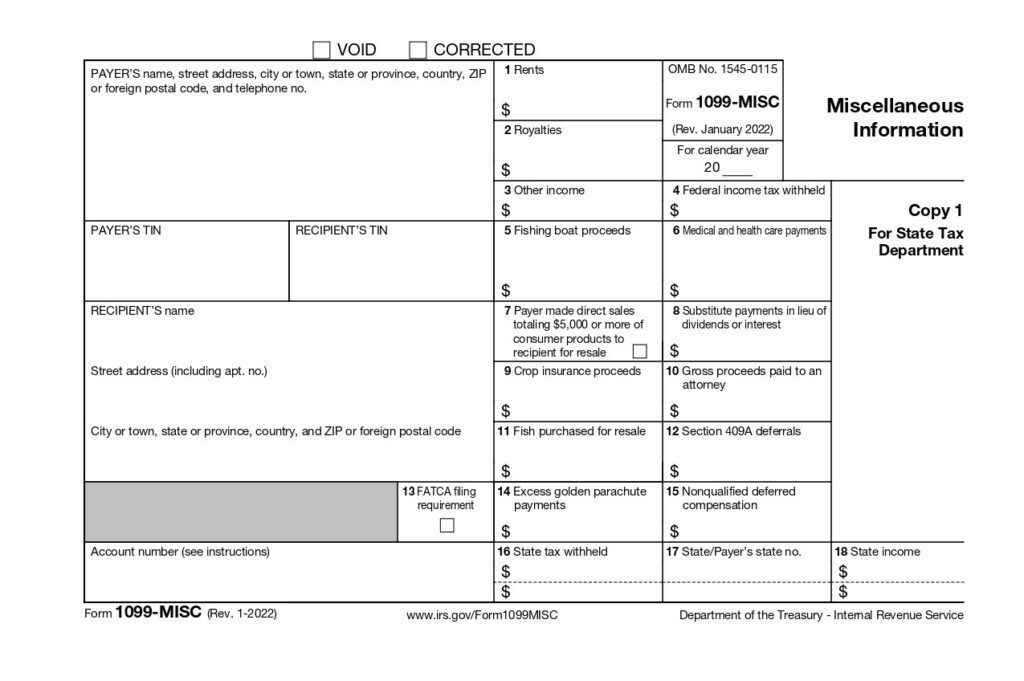

What is Form 1099-MISC?

A 1099-MISC tax form is a type of IRS Form 1099 that reports certain types of miscellaneous income. The Form 1099-MISC is used to report other income, such as rents, royalties, prizes, or awards paid to third parties. In general, a person will receive 1099-MISC to report payments that are not subject to self-employment tax.

If your business paid an individual or LLC at least $600 during the year in rent paid, legal settlements, prizes, or award-winnings, you are required to file a 1099-MISC.

Why do you need a 1099 Form?

If you or your business has hired an independent contractor and paid them over $600 during the financial year, you need the 1099 form. The last date to file your 1099s is January 31st.

If you do not receive your 1099 form for 2021 by the January 31st or February 15th deadlines, contact the person or business responsible for sending you the 1099. Request that they send you a copy of your 1099 so you can file your tax return on time.

Who is an Independent Contractor?

Independent Contractors are individuals who perform work for an entity, but they are not employees. The IRS defines Independent Contractors as “an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done”.

Independent Contractors vs. Employees

An employer must have a reasonable basis to classify a worker as an IC. Misclassifying a worker as an IC can have costly consequences for the employer. To understand the difference, you need to look at several factors.

The main difference between employees and independent contractors is in the benefits that they receive. An employee receives a regular wage, benefits like healthcare, and worker compensation.

On the other hand, an independent contractor is hired for a particular project. For this reason, the employer is not responsible for the benefits listed above and only has to pay what the contract states.

Difference between an Independent Contractor and an Employee

There are the following 3 main IRS tests to decide if a worker is an IC or an employee.

- Behavioral Control: if the work is performed without any direction or control by the business, the worker can be classified as IC. For example, an IC decides where and when to perform the work, and which tools to use to complete the job.

- Financial Control: Independent Contractors could generate profit or loss from the job. An IC does not usually get reimbursed for the expenses accrued for the project.

- Relationship: You usually hire an IC for a project, not as a permanent employee.

How does the IRS classify the ICs differently than the States?

Even though the IRS has strictly classified employees and non-employees, the IRS and some states may have a different approach to classifying a worker as IC. Likewise, the 1099 form with changes for 2021 will also affect how you approach the filing deadline.

The IRS accepts common employment law and based on common law, a worker is an IC if the employer has no or limited control over the worker. If you cannot determine how to classify the worker, you can fill out the IRS Form SS-8 and summate to the IRS. Based on the information on the form, the IRS will decide which class the worker belongs to. The IRS has also set 20 factors (Revenue Ruling 87-41) to determine exemptions for employee classifications.

On the other hand, some states may have different criteria for that. In California, since September 2019, Assembly Bill (AB) 5 requires any worker to be classified as an employee if the following conditions are not met:

- Free from control

- Outside the usual course of the hiring entity’s business

- The worker provides the same service to other clients

However, it excludes the following types of workers:

- Entertainers

- Media-related freelancers

- App-based drivers and contractors

On the other hand, Virginia (Virginia Employment Commission) applies the 20 factors set forth by the IRS. Based on employment law, a worker is an employee if the following conditions apply.

- Furnishes tools, materials, and equipment needed to do the work.

- Sets the hours of work.

- Withholds payroll federal and state income taxes and Social Security taxes.

- Receives direction and training from the employer about how to do the work; and

- Is paid by the hour, week, or month instead of being paid after a job.

Benefits of Independent Contractor and reporting payments in 1099-NEC

- The entity doesn’t pay any self-employment taxes (FICO)

- No unemployment taxes

- Less admin work and expenses since you don’t need to process payroll.

- No minimum wage requirements

- No equal pay requirement

It is important to classify and report worker payments accurately to avoid penalties from the IRS and other regulatory agencies. As the gig economy grows and freelancing expands, it is important to pay special attention to the accurate classification of a worker. An employer should keep the following documents from an IC.

- Business cards

- Professional license

- W-9 form

- A contractor agreement that outlines the work scope clearly

Dangers of Filing the Wrong Form

We get it, the filing date is nearing and you’re in a hurry to file the 1099 form for 2021. However, a small mistake can incur big penalties if you’re not careful. If you’re in doubt, you should always ask a professional to avoid misclassifying.

The penalties depend on the size of your business, the number of errors, and also on how late you file your taxes.

Similarly, you will also face penalties if you give a 1099 form to an employee who should receive a W-2 form. Misclassifying an employee as an independent contractor attracts higher penalties than the other way around. Hence, it’s important that you correctly identify your independent contractors and employees to ensure that they receive the right form.