Corporated is the simple past tense and past participle of corporate. The term “corporated” generally refers to the process of forming or organizing a corporation. Corporated is a modification of the word “corporate,” an adjective related to corporations. Here’s the meaning of “corporate” in English:

Corporate: Pertaining to a corporation or a group of companies. The term “corporate” is often used to describe the culture, structure, or operations of businesses that are organized as corporations. It can also refer to the collective identity of a company, including its values, goals, and practices. Examples of usage include “corporate culture,” “corporate governance,” and “corporate responsibility.”

Table of Contents

What Does “Corporated” Mean?

Corporated is a term related to the concept of corporations or corporate entities; the verb “incorporate” could be relevant. “Incorporate” means to form a corporation or include something as part of a whole. The simple past tense and past participle of “incorporate” are both “incorporated.”

A corporation is a legal persona or a legal entity that is apart from its shareholders. It is typically owned by shareholders and managed by a board of directors and officers.

What is Corporated?

In the process of being corporated, a business becomes a corporation by obtaining a corporate charter from the state. This charter legally establishes the corporation as a separate entity and outlines its powers and responsibilities.

Once a business is corporated, it becomes responsible for its debts and obligations, and its owners are generally not personally liable for those debts and obligations. This is known as limited liability protection. Corporations also can issue stocks and raise capital through the sale of those stocks.

Overall, being corporated can provide many benefits to a business. However, it also involves significant legal and financial responsibilities, such as following corporate governance rules and paying corporate taxes.

Benefits of a Corporation

Limited liability protection.

Corporate limited liability protection shields owners’ personal assets from the company’s debts and obligations.

01

The ability to raise capital.

A corporation can easily raise capital by issuing shares of stock to attract investors.

02

The potential for tax advantages.

Corporations can benefit from tax advantages, such as deductions for business expenses, which can reduce their taxable income.

03

Corporated vs. Incorporated

“Corporated” and “incorporated” are often used interchangeably to refer to the process of forming a corporation. However, “incorporation” is the correct term to use when referring to legally forming a corporation.

Corporation vs. Incorporation

Incorporation is the process of legally forming a corporation. This typically involves filing articles of incorporation with the state government and obtaining a corporate charter. A corporate charter outlines the powers and responsibilities of the corporation.

A corporation is a business structure that exists once it has been legally formed through incorporation. Incorporation is the act of legally forming a corporation.

How much Does It Cost to Start a Corporation?

The cost of starting a corporation can vary. It depends on several factors, mainly the corporation’s formation state. The type of corporation can affect the cost. Here are some general estimates of the costs involved in starting a corporation:

- Filing fees: Most states charge a fee to file articles of incorporation, which is the document that establishes a corporation. These fees can range from a few hundred dollars to over a thousand dollars.

- Legal fees: Hiring an attorney to handle the incorporation process can add significant costs. Legal fees can vary from a few hundred dollars to several thousand dollars. That depends on the matter’s complexity and the attorney’s experience.

- Registered agent fees: A corporation must appoint a registered agent who is responsible for receiving legal documents on behalf of the corporation. Some companies offer registered agent services for a fee, ranging from a few hundred dollars per year to over a thousand dollars per year.

- Ongoing costs: There are also ongoing costs of maintaining a corporation, including the cost of holding annual meetings, preparing and filing annual reports, and paying franchise taxes and other fees to the state. These costs can vary widely depending on the state and the size of the corporation.

Overall, the cost of starting a corporation can be a few hundred dollars. However, it can also cost several thousand dollars, depending on the abovementioned factors. It’s important to carefully consider the costs and benefits of incorporating before making the decision to form a corporation.

Incrpoare your business in Virginia.

C Corp vs. S Corp

A C corporation (C corp) is a type of business structure separate from its owners. This means the corporation, rather than the owners, is taxed on its profits. C corps are subject to corporate income tax and may also be subject to double taxation, as the profits of the corporation are taxed at the corporate level and again when they are distributed to shareholders as dividends.

On the other hand, an S corporation, also known as S Corp, is a type of business structure that is a hybrid of a C corporation and a partnership. Like a C corporation, an S corp is a separate legal entity from its owners. However, unlike a C corporation, an S corp is not subject to corporate income tax. Instead, the profits and losses of the S corp are passed through to the shareholders and are taxed at the individual level.

Both C corps and S corps offer limited liability protection to their owners, meaning that the owners are not personally liable for the debts and obligations of the business.

In general, C corps may be a good choice for larger businesses or businesses that plan to go public, while S corps may be a good choice for smaller businesses or businesses with a small number of owners. It’s important to carefully consider the pros and cons of each type of business structure before deciding which one is right for you.

Inc vs. Corp

“Inc.” is short for “Incorporated” and is a designation used for a corporation. “Corp.” is short for “Corporation”. Both are used to indicate that a business is a legal person separate from its owners, typically formed under state law. The choice of “Inc.” or “Corp.” often depends on the certain laws and regulations of the corporation’s jurisdiction.

LLC vs. Corporation

LLC (Limited Liability Company) and Corporation are two different business structures recognized by law. Both LLCs and corporations provide liability protection to owners and offer potential tax benefits, but the specifics depend on the individual company and the jurisdiction in which it is formed.

LLC offers a partnership’s flexibility with a corporation’s liability protection. Owners of an LLC are generally called “members” and are not personally responsible for the company’s debts or liabilities. Profits and losses can be passed through to members, which are reported on their personal tax returns.

A Corporation is a separate legal (person) entity from its owners, called “shareholders”. The shareholders have limited liability, which means they are not usually personally responsible for the company’s debts. The income of a corporation is taxed at the corporate level, and any profits distributed to shareholders as dividends may be taxed again at the personal level ( personal tax return).

What are “Articles of Incorporation”?

The Articles of Incorporation is the first and most important legal document that formally establishes a corporation and sets out its basic structure and purpose. It is filed with the appropriate state agency; usually the Secretary of State, to legally create the corporation. For example, when you register a corporation in Virginia, you have to file the Articles of Incorporation (Certificate of Incorporation or Corporate Charter) with the Virginia State Corporation Commission. That is the first step to making your business corporated.

The Articles of Incorporation typically include information such as:

- The corporation’s name and location

- The purpose of the corporation

- The type of stock the corporation will issue

- The names and addresses of the directors

- Any provisions regarding the management of the corporation

The Articles of Incorporation serve as the primary governing document for the corporation and can only be amended in accordance with the corporation’s bylaws and state law. They are important documents as they establish the legal existence of the corporation and set the framework for its operation.

Why Make Your Business Legally Corporated?

There are many advantages to making your business legally corporated. The most important benefits of a corporated business include the following:

- There is a practical method to raise capital by selling capital stock. This is particularly important for startups planning to raise money through investment from VCs.

- Owners have limited liability. Unless the owners mix business and personal affairs, usually, corporated companies protect owners’ personal assets from lawsuits.

- Corporations usually have unlimited lives unless the articles of incorporation provide for a shorter life. Coorporated business can be helpful to increase business assets and continuation of the legacy.

- A corporation is considered a person for most purposes. We, humans, are physical persons, but corporations are legal persons.

- Corporated businesses are relatively easy to transfer ownership interests.

- Corporations generally are easy to manage, and they have more management resources.

- Corporations can save taxes for the owners. Owner-employees generally may receive the full array of employer-provided tax-free fringe benefits.

- Shareholders can be individuals, estates, partnerships, or other corporations.

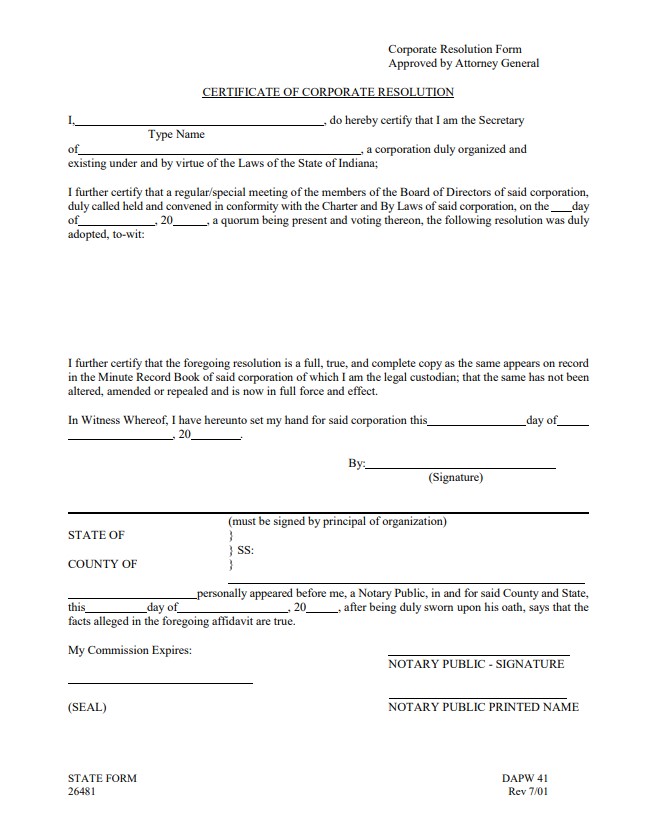

Corporate Resolution Form

A corporate resolution is a formal document that records the decisions made by a corporation’s board of directors or shareholders. A corporate resolution form is a template that can be used to create a corporate resolution.

Corporate resolutions are typically used to document important decisions or actions taken by a corporation, such as the adoption of a new policy, the appointment of an officer or director, or the authorization of a specific action or transaction.

A corporate resolution form typically includes the name of the corporation, the date of the resolution, and a description of the action or decision being taken. It may also include the names of the directors or shareholders who voted on the resolution and the outcome of the vote.

Corporate resolutions are typically required for certain types of decisions or actions. Examples are when corporations involve the expenditure of significant amounts of money or the creation of new debt. They may also be required by law or by the corporation’s bylaws.

Overall, corporate resolutions serve as a record of important decisions and actions taken by a corporation and can help to provide transparency and accountability within the organization.

Download the corporate resolution form.

Sample corporate resolution form

What Is a Corporate Charter?

A corporate charter is a legal document that establishes a corporation and outlines its powers, rights, and responsibilities. The corporate charter is typically filed with the state government when a corporation is formed and serves as the corporation’s constitution.

A corporate charter typically includes the following information:

- The name of the corporation

- The purpose or mission of the corporation

- The location of the corporation’s principal office

- The names and addresses of the directors of the corporation

- The number and class of shares of stock that the corporation is authorized to issue

- The terms of any special rights or privileges associated with the corporation’s stock

- Any other provisions that the corporation’s founders wish to include, such as rules for holding meetings or electing directors

A corporate charter is an important legal document that defines the relationship between the corporation and its owners, shareholders, and other stakeholders. It is important to carefully consider the terms of a corporate charter before forming a corporation to ensure that it meets the needs and goals of the business.

Incorporate your corporation for free

NumberSquad offers free incorporation services for new business owners in Virginia, Maryland, the District of Columbia, and Delaware. Register your LLC or incorporate your company for free by NumberSquad.

Learn more about Virginia LLC

Consider registering a Virginia LLC if you are starting a business in Virginia. A Virginia LLC provides its owners with legal protection and potential tax benefits.