Reasonable compensation for S-Corp owners is the salary that the IRS considers fair and similar to what employees in similar roles get in comparable businesses. A reasonable S-Corp salary is the justifiable amount of compensation paid to an owner-employee for their services within the company, typically determined by evaluating factors such as industry standards, job responsibilities, training, and time devoted to the business, with calculation methods varying from using compensation analysis reports to the 60/40 rule, which divides business income into 60% salary and 40% shareholder distributions.

To avoid IRS issues, self-employed individuals and business owners must figure out this fair salary. This guide will help you grasp the basics of reasonable S-Corp owner salaries and provide simple calculation steps. Setting a reasonable salary can maximize your earnings and reduce the risk of IRS audits that could cost your business dearly.

What is an S Corporation Salary?

For self-employed individuals and small business owners, choosing to operate as an S Corporation (S Corp) can be a smart move for tax savings. However, it’s essential to understand that the IRS has specific rules about paying yourself in an S Corp. The IRS requires you, as the owner, to receive a “reasonable salary” for the work you do within your business. Only after paying this reasonable salary can you take additional profits from your business as distributions, often with lower tax rates.

S Corp Salary Calculator

Calculate reasonable compensation for your S-Corp easily. This online tool allows you to input various factors such as industry and task allocation to determine a reasonable salary for S Corp owners. It provides valuable insights into ensuring compliance with IRS regulations while optimizing tax strategies for small business owners.

How to Use the S-Corp Salary Calculator?

Use this S-Corp Owner Salary Calculator if you’re a full-time self-employed individual earning a substantial income, such as $150K net income. This straightforward tool helps you grasp the basics of S-Corp reasonable compensation calculation. For optimal S Corp salary optimization, additional facts may be required.

What is Reasonable Compensation?

Reasonable compensation, or salary, is important for self-employed individuals and small business owners who operate as S Corporations (S Corps). Essentially, it’s the amount you pay yourself from your business for your work.

To determine what’s “reasonable,” you should consider your training, duties, time spent on the business, and what others in your field typically get paid. The IRS doesn’t set a fixed salary amount in stone, but instead, they look at industry standards and your business’s income to determine if you’re paying yourself fairly.

Here’s a simple guide: What would your salary be if you worked for another company doing the same job? That’s a good starting point for your reasonable compensation. But there are many details involved here. And remember, this rule comes into play mainly when you’re taking distributions from your business profits. Don’t worry about paying high salaries if your business has just started and has yet to profit. As your business grows, you can adjust your salary accordingly. It’s all about finding the right balance while staying in line with IRS rules to enjoy the tax benefits of an S Corp.

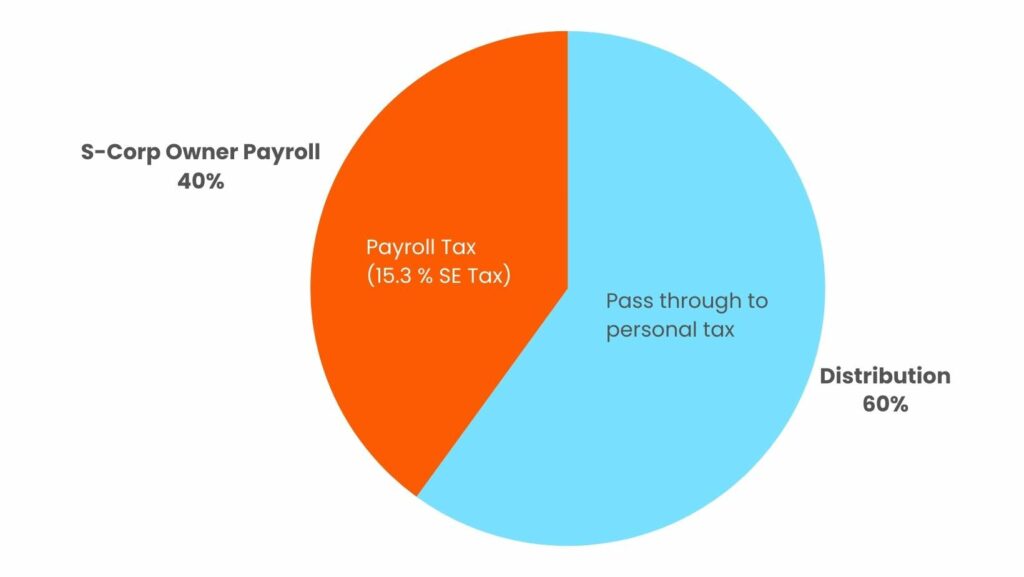

S-Corp Distributions vs. S-Corp Salary

When you run your business as an S Corporation (S-Corp), it’s crucial to understand the difference between S-Corp distributions and salary, especially for self-employed individuals and small business owners. In simple terms, here’s what you need to know:

Distributions are the profits (or losses) your S Corp passes on to you as the owner (shareholder). Distributions are not considered employee wages and are not treated as self-employment income. The significant advantage is that you don’t have to pay payroll taxes on distributions. This means you can save on the 15.3% tax that covers Medicare and Social Security.

Salary is the money you pay yourself as an official employee of your S Corp, often referred to as reasonable compensation. The IRS mandates that S Corp shareholder-employees receive a reasonable salary, typically defined as what other businesses pay for similar services. It’s essential to note that you must pay payroll taxes on your salary, just like any other employee.

S-Corp Profit: Distribution vs. S-Corp Owner Salary

While it might be tempting to classify all your income as distributions to reduce taxes, the IRS sets a crucial rule: you must pay yourself a “reasonable salary.” This prevents people from evading taxes by disguising their salaries as distributions. Follow this rule to avoid severe penalties and a substantial back-tax bill if the IRS audits your S Corp income and reclassifies it as salary. These penalties can include tax fines of up to 100% and negligence penalties.

How to Calculate Reasonable Compensation for a Profitable S-Corp?

Calculating a reasonable salary for yourself as a self-employed individual or a small business owner, especially when you perform multiple roles. The IRS usually prefers a market-based approach when determining a reasonable salary. This means breaking down the employee’s job into parts and looking at salary surveys to see what similar jobs in the market pay for each part. Then, add those amounts together to find the total cost. This approach can seem daunting, but it can be split into a few simple steps:

Step 1: Allocate Your Work Time

Determine the percentage of time you spend on each role within your business based on a standard 40-hour workweek. Note that you may reduce this to less than 40 hours per week if you have another job or side business.

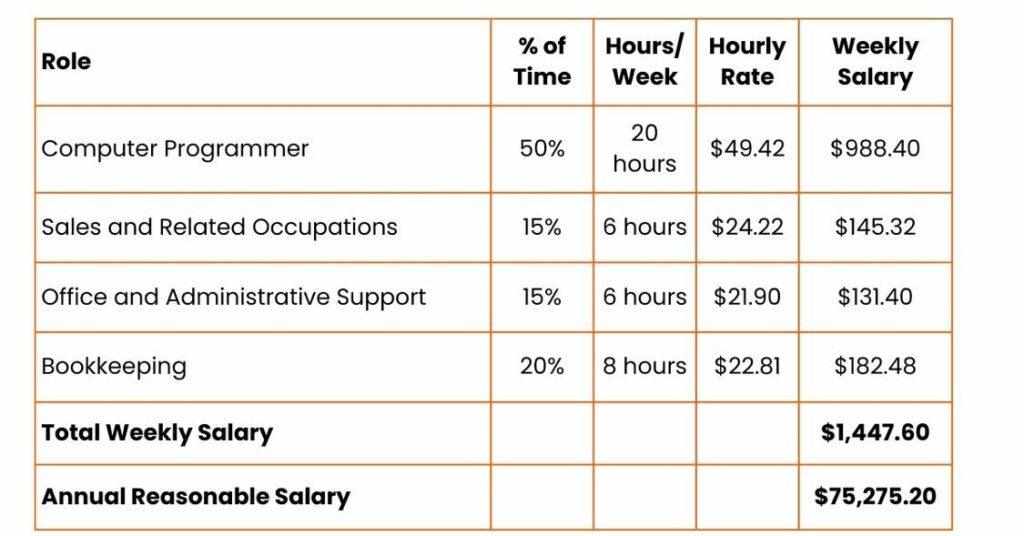

To understand this better, imagine you are self-employed and running an IT Consulting business under an S-Corp. Now, let’s allocate your work time:

- Computer Programmer: 50% of your time (20 hours per week)

- Sales and Marketing: 15% of your time (6 hours per week)

- Office Management/Administration: 15% of your time (6 hours per week)

- Bookkeeping: 20% of your time (8 hours per week)

Step 2: Research Comparable Pay Rates

Find salary information for each role to determine the appropriate pay rates. You can use the website of the Bureau of Labor Statistics (BLS) as a source, which offers detailed data on average hourly wages for various occupations. Keep in mind that pay rates can vary based on your location. You may reduce or increase rates based on location, city, or county. Here are the average rates from the BLS website as of today (date on this article written):

- Computer Programmer: $49.42 per hour

- Sales and Related Occupations: $24.22 per hour

- Office and Administrative Support Occupations: $21.90 per hour

- Bookkeeping, Accounting, and Auditing Clerks: $22.81 per hour

Step 3: Calculate the Reasonable Salary

Now, calculate the reasonable salary for each role based on the numbers and information gathered in Step 2. Multiply the hours spent on each task by the corresponding pay rate. For example:

- Computer Programmer: 20 hours x $49.42 = $988.40 per week

- Sales and Marketing: 6 hours x $24.22 = $145.32 per week

- Office Management/Administration: 6 hours x $21.90 = $131.40 per week

- Bookkeeping: 8 hours x $22.81 = $182.48 per week

Step 4: Determine Annual Reasonable Salary

Sum up the weekly salaries for all roles:

- Total Weekly Salary: $988.40 + $145.32 + $131.40 + $182.48 = $1,447.60 per week

To find your annual reasonable salary, multiply the total weekly salary by the number of weeks in a year (typically 52 weeks):

- Annual Reasonable Salary: $1,447.60 x 52 = $75,275.20 per year

Sources to Use for S-Corp Salary Rates

Use industry statistics as a reference point to determine your pay; it’s wise to. This means looking at data that shows what people in similar jobs are typically paid. You can access this information through various sources. One option is the Bureau of Labor Statistics, which provides detailed salary data for around 800 job types, offering a comprehensive view of industry pay standards. Additionally, employer-review websites like Glassdoor, Salary, and PayScale collect employee salary information, making it easy to find what others earn in specific companies, roles, industries, and locations. Another choice is RC Reports, which offers reports designed for reasonable compensation analysis, providing valuable insights for setting your pay.

What is the S-Corp Salary 60/40 Rule?

The S Corp salary 60/40 rule (or similar rules like the 50/50) suggests splitting business revenue into specific percentages for salary and distributions. However, these rules can be arbitrary and may not align with IRS guidelines. The IRS expects you to determine reasonable compensation based on your circumstances. 40% of net income as an S-Corp salary may be acceptable when the business does not have enough cash flow. Calculating your reasonable S-Corp compensation based on your specific financial situation is better to ensure IRS compliance and optimize your income structure.

Can You Pay 1099 to Yourself Instead of S-Corp’s Salary?

Starting payroll for your S Corporation can be complex, time-consuming, and costly. Some may think it’s easy to give the owner a 1099 at the end of the year and handle self-employment taxes on personal tax returns. However, this shortcut can increase the chance of being audited. There’s a specific spot on the S Corporation tax form (Form 1120-S) where you should report a fair salary for S-Corp owners. If you don’t do this and don’t provide a W-2, it can raise red flags during tax filing. Additionally, the IRS may not like this approach, which could mean missing out on tax-saving benefits that come with your S-Corp status.

Do You Pay Reasonable Compensation if Your S-Corp is Not Profitable?

Suppose your S Corporation still needs to turn a profit. In that case, it’s essential to remember that the S Corp “reasonable salary” requirement primarily applies when you and other shareholders are taking distributions from the Company’s profits. The IRS doesn’t impose a minimum salary requirement, so there’s no need to worry if your business needs to generate more income to pay yourself a salary that matches industry standards. During lean periods, focus on reinvesting in your Company’s growth and stability. You can revisit your compensation structure as your S Corp becomes more profitable. In the meantime, consult with a tax professional to ensure you meet all legal and reporting obligations, even when profitability is a work in progress.

How to Pay S-Corp Salary to Yourself?

Self-employed individuals who own an S corporation pay themselves using a combination of salary and distributions. Here’s a simplified process:

- Set a Reasonable Salary: Determine a fair salary that aligns with industry standards for your role within the business.

- Calculate and Withhold Taxes: Calculate income tax, FICA (Social Security and Medicare) taxes, and unemployment taxes based on your salary.

- File Federal Quarterly Taxes: Use IRS Form 941 to report taxes withheld from your salary and consider Form 1040-ES for additional income.

- Record Payroll Transactions: Keep clear records of wage expenses, payroll taxes, and shareholder distributions for accurate tracking.

- Handle State Payroll Taxes: If required, file state income and unemployment tax payments quarterly.

- Prepare Year-End Tax Documents: Complete and submit Form W-2, Form W-3, Form 1120S, and Schedule K-1 to report income, deductions, and tax credits.

By following these steps, self-employed S corporation owners can efficiently manage their salary and tax obligations, staying compliant with IRS rules and optimizing their tax efficiency.

How to Document Your Reasonable S-Corp Salary?

For S-Corp owners, it’s crucial to document your reasonable salary properly. This helps prove that the amount you pay yourself is fair. This is especially important when your business makes money and receives cash payments. Here are three simple steps to do it:

Step 1: Document Calculations

Keep records of how you came up with your salary amount. For example, note the time you spend on different tasks and the rates you use for each job. Websites get updated all the time. Save records of the salary statistics you have used.

Step 2: Wage Stats

Save copies of the wage information you use, like the Department of Labor data. They update wage figures yearly so that you might have access to different numbers later.

Step 3: Corporate Document

Create a brief and straightforward “Minutes of Meeting of Directors.” This is a good practice for recording important decisions for your S-Corp. You can find a sample Minutes of the Meeting of Directors below;

MINUTES OF MEETINGS OF DIRECTORS OF XYZ CORPORATION

We, the directors of XYZ CORPORATION (The Company), agree to the following action on ____________, 20 ____.

Resolved, that the Company adopts the report attached to this document and pays John Doe an annual salary of $50,000 for the duties outlined in that report.

Name: _______________

Signature _____________

Date_________________

Reduce Taxes by Treating Medical Insurance Premiums as Wages

Understanding health insurance premiums for >2% of S-Corp owner-employees is crucial. It optimizes S-Corp compensation by increasing salary while minimizing SE tax. When the S-Corp pays these premiums for such shareholders, they’re deductible and reported as wages on Form W-2, subject to income tax withholding.

These wages aren’t subject to Social Security, Medicare, or unemployment taxes if they are part of a comprehensive employee coverage plan. While included in Box 1 of Form W-2, they’re excluded from Boxes 3 and 5.

A >2% shareholder-employee qualifies for an above-the-line deduction for medical care premiums, reducing their AGI. This deduction is available if coverage is S Corp-established and other self-employed medical insurance criteria are met. It’s not available if the shareholder/spouse is eligible for subsidized health care. This deduction lowers gross income, aiding tax savings.

S Corp Salary vs. Health Insurance Purchased in Name of Shareholder

For self-employed individuals and small business owners running S Corporations (S Corps), it’s crucial to understand how health insurance works when you’re the sole employee. In some states, insurance laws don’t allow a corporation to buy group health insurance when there’s only one employee, which can be true for many S-Corp shareholders.

To address this, the IRS issued Notice 2008-1, which provides rules for a 2-percent shareholder to qualify for an above-the-line deduction, even if the health insurance policy is purchased in the shareholder’s name. There are specific scenarios:

-

Shareholder Purchases Insurance Individually:

If the shareholder buys health insurance in their name and pays for it with their funds, they typically wouldn’t qualify for an above-the-line deduction.

-

S Corp Purchases and Covers Shareholder:

If the S Corporation obtains and pays for health insurance in its name, includes the shareholder under the policy, and reports the premiums as W-2 wages to the shareholder, then the shareholder can claim an above-the-line deduction.

-

Shareholder Buys, S Corp Pays or Reimburses:

Suppose the shareholder purchases health insurance in their name. Still, the S Corporation either directly pays for the insurance or reimburses the shareholder for it while reporting the premium payment in the shareholder’s W-2. In that case, the shareholder can qualify for an above-the-line deduction.

For a shareholder to claim this deduction, the S Corporation must ultimately cover the health insurance premiums and report them as taxable compensation in the shareholder’s W-2. This ensures that the shareholder can benefit from the deduction while complying with tax regulations.

What Approaches Does the IRS Accept for Reasonable Compensation?

For self-employed individuals and small business owners running S Corporations (S Corps), understanding reasonable compensation and avoiding disputes with the IRS is crucial. While many tax court cases provide precedent, clients often prefer to avoid legal battles. Recent IRS guidance offers valuable insights to preempt such disputes regarding employee compensation and federal tax treatment.

The IRS suggests using three common valuation methods to estimate reasonable compensation:

Industry Comparison

This method involves comparing the employee’s compensation to what others in the same industry typically earn. It’s usually the starting point for IRS analysts when considering audits for reasonable compensation.

Investor Satisfaction

Given the current owners ‘ compensation levels, this approach assesses whether an independent investor would be content with the business’s financial performance.

Component-Based Analysis

A valuator breaks down the employee’s duties into various components, using salary surveys to determine market compensation for each element. The total cost is then calculated.

While these approaches are considered, IRS guidance generally leans toward the market approach, which involves comparing compensation to industry standards. The income and cost approaches and financial analysis help refine the estimate of reasonable payment. By applying these methods and staying informed about IRS guidelines, self-employed individuals and small business owners can navigate the complex landscape of reasonable compensation and minimize the risk of disputes with the IRS.

Court Cases Regarding Reasonable Compensation

Following court cases helps to understand the importance of S-Corp salary and how the IRS determines reasonable companies.

Joly v. Commissioner

In this 1998 court case, four individuals, namely J. Michael Joly, Bonnie B. Joly, Jody Steven Joly, and David Andrew Joly, found themselves in a dispute with the IRS. The disagreement revolved around their federal income taxes and accuracy-related penalties, specifically for the 1992, 1993, and 1994 tax years.

The primary concerns of the case included whether specific payments, originating from J. Michael Joly, Inc., to J. Michael Joly and Jody Steven Joly, should be categorized as S-Corp salary. Additionally, the case delved into the intricacies of calculating gains and losses associated with their stock holdings within the corporation. Lastly, the matter of potential liability for accuracy-related penalties was examined for J. Michael Joly and Bonnie B. Joly.

The court found that the payments made to J. Michael Joly and Jody Steven Joly should be considered employee wages. They had to receive reasonable S Corporation compensation and pay payroll tax. Additionally, the court ruled on the correct method to calculate the gains and losses for their stock in the corporation. Finally, the court determined that J. Michael Joly and Bonnie B. Joly were liable for accuracy-related penalties due to negligence in their tax reporting.

David E. Watson, P.C v. U.S.

In the court case of David E. Watson, P.C. v. U.S., the United States recharacterized dividend and loan payments from David E. Watson, P.C. (DEWPC) to its shareholder and employee, David E. Watson, as wages. This recharacterization led to additional employment taxes, interest, and penalties being assessed against DEWPC for multiple calendar quarters in 2002 and 2003. DEWPC contested these assessments, arguing that its intent to pay Watson a $24,000 annual salary was legitimate and should control whether the funds paid to Watson were categorized as wages or dividends. The court found that DEWPC’s $24,000 salary for Watson was unreasonable based on the facts and circumstances of the case. They determined that a reasonable salary for Watson should have been $91,044 annually. As a result, DEWPC was required to pay employment taxes, interest, and penalties on the recharacterized amounts. The court also ruled that the additional compensation should be applied ratably throughout each of the two years.

What is S Corp Salary per IRS?

Corporate officers, including those in Subchapter S corporations, fall under the employee category for FICA, FUTA, and federal income tax withholding. When these officers provide services to the corporation and receive or are entitled to payments, these payments are generally considered wages. S corporations should classify compensation for officer services as wages and not as cash distributions or loans to shareholders. S corporations, which pass income through to shareholders for tax purposes, must adhere to the Internal Revenue Code, designating all corporate officers as employees for federal employment tax purposes. Attempting to circumvent employment taxes by categorizing officer compensation as distributions or personal expenses is discouraged. This fact sheet provides important insights for small business taxpayers regarding tax regulations for corporate officers performing services.

How to Pay S Corp Reasonable Compensation per IRS?

Establishing reasonable compensation for shareholder-employees in an S corporation depends on assessing the source of the corporation’s gross receipts. These sources primarily include the services of the shareholder, non-shareholder employees, and capital/equipment. If gross receipts arise from non-shareholder employees or capital/equipment, payments to the shareholder can be categorized as non-wage distributions exempt from employment taxes. However, if the shareholder’s personal services generate gross receipts, these payments should be considered wages subject to employment taxes. Additionally, if the shareholder provides administrative support to income-producing employees or assets, they may also be subject to wage treatment. Factors influencing reasonable compensation encompass training, duties, time invested, dividend history, payments to other employees, bonus structures, industry benchmarks, formal compensation agreements, and a formula for determining compensation.

In Summary

Ensure you understand the benefits of S Corp dividend vs. salary and pay reasonable compensation to yourself as W-2 wages when your S-Corp is profitable. Optimize your S-Corp salary to avoid overpaying unnecessary payroll taxes. Ensure you take advantage of health insurance reimbursement by including it in your S Corp salary. You increase your S Corp salary and reduce your Self-employment taxes by reporting your medical insurance in your W-2. Proper S Corp officer compensation will help you avoid unnecessary IRS audit risk and save you money on your SE taxes.

« I confirm the subscription of this blog to the Paperblog service under the username %numbersquad.»

Frequently Asked Questions About S-Corp:

What is an S-Corp?

An S Corporation (S Corp) is a business structure that allows taxable income, credits, deductions, and losses to pass directly to shareholders, offering advantages over C-Corps. Limited to 100 or fewer shareholders, an S-Corp is an alternative to LLCs. S-corps and LLCs, known as pass-through entities, pay no corporate taxes; shareholders bear the tax burden. S-Corps provide incorporation benefits with partnership taxation, while LLCs offer greater flexibility. S corp shareholders include individuals, specific trusts/estates, or certain tax-exempt organizations, while LLCs attract sole proprietors or small professional groups with fewer IRS restrictions.

How Do You Maximize Tax Savings With an S-Corp?

Selecting the right business entity is pivotal for reducing tax obligations, and an S Corporation (S Corp) presents an excellent option for small to medium-sized businesses. A key advantage is pass-through taxation, allowing profits and losses to be reflected in shareholders’ tax returns, thus avoiding the double taxation associated with C Corporations. S Corps permits deductions for business expenses such as salaries, wages, and bonuses, resulting in substantial tax savings. Furthermore, they may qualify for a 20% deduction on qualified business income under the Tax Cuts and Jobs Act of 2017, making them appealing to small business owners aiming to minimize taxes.

How to Calculate S-Corp Tax?

An S corporation tax calculator assists in estimating taxes when filing business taxes as an S corporation versus a sole proprietorship. Self-employed individuals, including 1099 recipients, independent contractors, and freelancers, often file taxes as sole-proprietorship alongside personal tax returns under Schedule C. Single-member LLC owners may opt for either sole-prop or S corp tax filing. While tax calculation can be intricate, grasping key tax terms is crucial when utilizing an S-Corp tax calculator.

Use this S-Corp tax calculator to estimate your tax savings, comparing filing taxes as a sole proprietor versus an S-Corporation, assuming a 40% owner salary.

How Does it Work?

As an S Corporation, you enjoy reduced self-employment and payroll taxes compared to a sole proprietorship or partnership.

Employment Tax:

This tax applies to business salaries, including self-employed income.

Federal Income Tax:

It applies to business profits after deductions.

How to Form an S-Corp?

Here are the steps to form an S Corporation:

- Establish your LLC or Corporation: Register with your state’s business formation agency, appoint a registered agent, and obtain the necessary documents.

- Obtain a Federal Tax ID Number: Get a FEIN from the IRS for tax purposes.

- Confirm eligibility: Ensure your business meets IRS requirements for S-corp status, including stock and shareholder limits.

- File S-Corp Election: Submit Form 2553 to the IRS within the specified timeframe.

- Maintain Compliance: Continuously adhere to IRS regulations regarding shareholders and stock.